Inventory is one of the most critical assets for any business. Yet, managing inventory can be a daunting task for businesses of all sizes. One metric that can help in this regard is days sales in inventory (DSI). In this article, we’ll cover what DSI is, why it matters, and how it can help businesses optimize their inventory management.

What Is Days Sales of Inventory (DSI)?

Days sales of inventory, or DSI, is a financial metric that measures how long it takes for a company to turn its inventory into sales. It is calculated by dividing the inventory balance by the average daily cost of goods sold (COGS). In simple terms, it tells you how many days it takes for a company to sell its entire inventory.

DSI is an important metric for businesses to track because it can help them optimize their inventory management. If a company has a high DSI, it means that they are holding onto inventory for a long time, which ties up capital and can lead to increased storage costs. On the other hand, if a company has a low DSI, it means that they are selling their inventory quickly and efficiently, which can lead to increased profits.

There are several factors that can affect a company’s DSI. For example, if a company has a high volume of sales, it may have a lower DSI because it is selling its inventory more quickly. Similarly, if a company has a low volume of sales, it may have a higher DSI because it is taking longer to sell its inventory.

Another factor that can affect DSI is the type of inventory a company carries. For example, if a company carries perishable goods, it may have a lower DSI because it needs to sell its inventory quickly before it spoils. On the other hand, if a company carries durable goods, it may have a higher DSI because these items can be sold over a longer period of time.

DSI is also important for investors to consider when evaluating a company’s financial health. A high DSI could indicate that a company is experiencing slow sales or poor inventory management, while a low DSI could indicate that a company is experiencing strong sales and efficient inventory management.

In conclusion, DSI is a key metric for businesses to track as it can provide valuable insights into inventory management and overall financial health. By understanding the factors that affect DSI and taking steps to optimize inventory management, companies can improve their profitability and long-term success.

Days Sales of Inventory (DSI) Formula and Calculation

The Days Sales of Inventory (DSI) is a financial metric that measures the number of days it takes for a company to sell its inventory. It is also known as Inventory Days or Days Inventory Outstanding (DIO). DSI is an essential metric for businesses that carry inventory, as it helps them to manage their inventory levels and cash flow effectively.

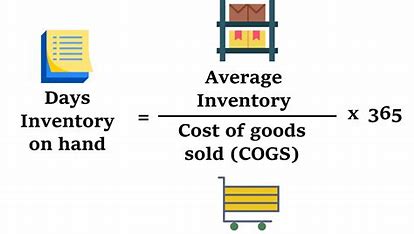

The formula for calculating DSI is straightforward:

- First, determine the average daily cost of goods sold (COGS) by dividing the total cost of goods sold by 365 (the number of days in a year).

- Next, divide the ending inventory balance by the average daily COGS.

- The result is the number of days of sales that are represented by the current inventory balance.

For example, if a company has an ending inventory balance of $100,000 and an average daily COGS of $1,000, the DSI would be:

DSI = Ending Inventory Balance / Average Daily COGS

DSI = $100,000 / $1,000 = 100 days

This means that it would take the company 100 days to sell its entire inventory.

It is important to note that DSI can vary significantly between different industries and businesses. For example, a company that sells perishable goods such as food or flowers will have a much lower DSI than a company that sells durable goods such as furniture or electronics.

DSI is a useful metric for businesses to monitor, as it can help them to identify potential inventory management issues. A high DSI may indicate that a company is carrying too much inventory, which can tie up cash flow and increase storage costs. On the other hand, a low DSI may indicate that a company is experiencing stockouts and missing out on potential sales.

How to Calculate Days Sales in Inventory (Step-by-Step)

Calculating days sales in inventory (DSI) is an important metric for any business that carries inventory. It helps to determine how long it takes for a company to sell its inventory and how efficient it is in managing its inventory levels. In this article, we will go through the steps to calculate DSI.

Let’s say that a company has an ending inventory balance of $100,000 and cost of goods sold of $500,000 in the last year.

- First, find the average daily cost of goods sold by dividing $500,000 by 365. This yields a result of $1,369.86.

- Next, divide the ending inventory balance of $100,000 by the average daily COGS of $1,369.86. This yields a result of 73 days.

Therefore, the company has 73 days of sales represented by the current inventory balance. This means that it takes the company 73 days to sell its entire inventory. A high DSI value indicates that a company is not efficiently managing its inventory, while a low DSI value indicates that a company is managing its inventory efficiently.

It is important to note that DSI should be compared to industry averages to determine if a company is performing well or not. Different industries have different inventory turnover rates, so it is important to compare DSI to the industry average to get an accurate picture of a company’s performance.

In addition, DSI can be used to forecast future inventory needs. By calculating DSI, a company can determine how much inventory it needs to carry to meet its sales goals. This can help to prevent stockouts and overstocking, which can both have negative impacts on a company’s bottom line.

In conclusion, calculating days sales in inventory is an important metric for any business that carries inventory. By following the simple steps outlined above, a company can determine how long it takes to sell its inventory and how efficiently it is managing its inventory levels. This information can be used to make informed decisions about inventory management and forecasting future inventory needs.

What DSI Tells You

DSI, or Days Sales of Inventory, is an important metric that offers valuable insights into a company’s inventory management efficiency. Essentially, DSI measures the average number of days it takes for a company to sell its entire inventory. The lower the DSI figure, the more efficiently a company is managing its inventory.

Effective inventory management is crucial for any business, as it can have a significant impact on profitability. Inefficient inventory management can lead to excess inventory, which ties up capital and can result in increased storage costs and potential write-offs. On the other hand, too little inventory can result in stockouts, lost sales, and dissatisfied customers.

By tracking DSI, businesses can gain a better understanding of how well they are managing their inventory. A low DSI figure indicates that a company is selling its inventory quickly, which can help to free up capital for other business needs. It can also indicate that a company is effectively managing its inventory levels, ensuring that it has enough stock on hand to meet demand without overstocking.

However, it’s important to note that DSI should be used in conjunction with other metrics to gain a complete picture of inventory management efficiency. For example, businesses should also track inventory turnover, which measures how many times inventory is sold and replaced over a given period. By combining DSI with inventory turnover, businesses can gain a more comprehensive understanding of their inventory management efficiency and identify areas for improvement.

In conclusion, DSI is a valuable metric that can provide insights into a company’s inventory management efficiency. By tracking DSI and other relevant metrics, businesses can optimize their inventory management processes and improve their bottom line.

DSI vs. Inventory Turnover

While both DSI and inventory turnover are measures of inventory management, there are a few key differences between the two. Inventory turnover measures how many times a company sells and replaces its inventory within a given period, while DSI measures the number of days of sales represented by the current inventory balance.

Understanding the difference between these two metrics is important for businesses that want to optimize their inventory management processes. Inventory turnover is a measure of efficiency, as it indicates how quickly a company is able to sell its inventory and generate revenue. A high inventory turnover ratio is generally considered a positive sign, as it suggests that a company is effectively managing its inventory and turning over its stock quickly.

However, inventory turnover alone doesn’t provide a complete picture of a company’s inventory management practices. This is where DSI comes in. DSI takes into account the amount of inventory a company has on hand and how quickly it is selling that inventory. A high DSI indicates that a company may be carrying too much inventory, which can tie up valuable resources and lead to increased storage costs.

For example, let’s say Company A has an inventory turnover ratio of 5, which means it sells and replaces its inventory 5 times per year. Company B, on the other hand, has an inventory turnover ratio of 3, but a DSI of 30 days, while Company A has a DSI of only 10 days. This suggests that Company B may be carrying too much inventory, which could lead to increased storage costs and decreased profitability over time.

In conclusion, while both inventory turnover and DSI are important metrics for measuring inventory management, they provide different insights into a company’s inventory practices. By understanding the differences between these two metrics, businesses can make more informed decisions about how to optimize their inventory management processes and improve their bottom line.

Why the DSI Matters

DSI is crucial because it helps companies in multiple ways. Firstly, it helps them to identify which products are selling quickly and which ones are not. Secondly, it can help companies to order the right amount of inventory, avoiding stockouts or overstocking. Thirdly, it can help companies to improve their cash flow by reducing their inventory holding costs.

Importance of Days Sales Inventory to Businesses and Investors

For businesses and investors, the DSI metric provides insight into a company’s ability to convert its inventory into sales. By monitoring a company’s DSI, investors can understand the operational efficiency of a business, which can help them make informed investment decisions.

Indications of Low and High DSI

A low DSI indicates that a company is selling its products more quickly than it is replenishing its inventory. This is generally a positive sign indicating high inventory efficiency. A high DSI indicates that a company is struggling to sell its products or is carrying too much inventory.

Optimizing Your Inventory Management Strategy with DSI

DSI can help businesses optimize their Inventory Management strategy by identifying the ideal level of inventory needed to meet customer demand while avoiding costly overstocking. This, in turn, can help improve cash flow, reduce carrying costs, and enhance profitability.

The Role of DSI in Strategic Planning

DSI plays a key role in strategic planning by providing insights into inventory management that can help businesses to achieve their long-term goals. By monitoring DSI, companies can optimize inventory levels, improve cash flow, and boost profitability, which can ultimately drive long-term growth and success.

Conclusion:

DSI is a powerful metric that can provide businesses with insight into inventory management efficiency. It can help companies identify which products are selling, optimize inventory levels, and improve cash flow. By monitoring DSI, businesses can make informed decisions that can drive long-term growth and success.